âTARS - the DeFi agent

the intelligence of the agentic onchain treasury

âTARS is the intelligence layer of aarna's agentic onchain treasury. AI-driven multi-agent system managing DeFi investments with autonomous risk & returns optimization and treasury capital allocation across âtv vaults

access âTARS strategies via ASRT

[minimum 5 required]

âTARS performs three core functions

intelligence

execution

conversation

intelligence

execution

conversation

and âTARS allocates $AARNA treasury capital into âtv vaults

live strategy

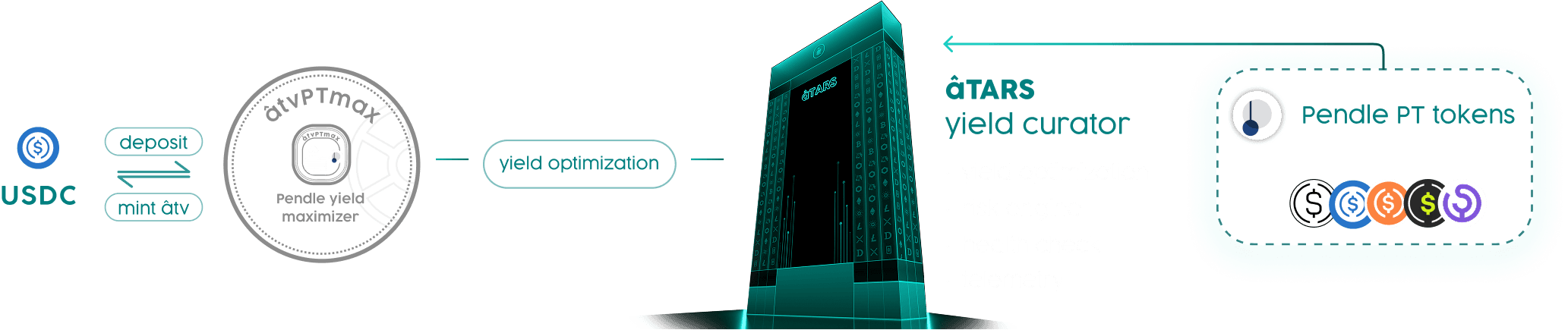

âtvPTmax: AI-curated fixed yields from pendle

âTvPTmax leverages the âTARS AI agent to dynamically allocate into Pendle PTs, locking fixed yields across diversified tenors while mitigating slippage and oracle drift. Built on aarna's tokenized vault stack, it converts DeFi primitives into secure, on-chain investment products with automation, transparency, and consistent performance

$AARNA: collaborate with the DeFi agent

the protocol token confers agentic access, governance, & participation rights

treasury sales of $AARNA flow directly into âtv vaults. As âTARS grows AUM, from direct and LP flows into atv vaults, $AARNA accrues value. Protocol fees grow and flow back to buyback $AARNA - the agentic onchain treasury becomes the meta exposure to DeFi